Homeownership is often considered part of the American dream, but for many, the upfront costs—down payment, closing costs, inspection fees—are intimidating barriers. Fortunately, there are programs designed to ease that burden. Whether you're browsing homes for sale near me or just beginning your journey into real estate, knowing how REI Assistance, 1st time home buyers grants, and closing cost assistance work can make all the difference.

Brian & Jonelle of B&J Co. | INC Realty, as a top Texoma realtor team, frequently guide clients through these programs—matching grants with properties and ensuring the process is smooth and understandable.

What Is REI Assistance?

REI Oklahoma is an organization that supports homeownership by providing down payment and closing cost assistance to eligible Oklahomans through partnerships with approved lenders. REI Oklahoma+1

One flagship program is REI Home100:

● It provides down payment and closing cost help to qualified homebuyers across Oklahoma. Bankrate+3REI Oklahoma+3REI Oklahoma+3

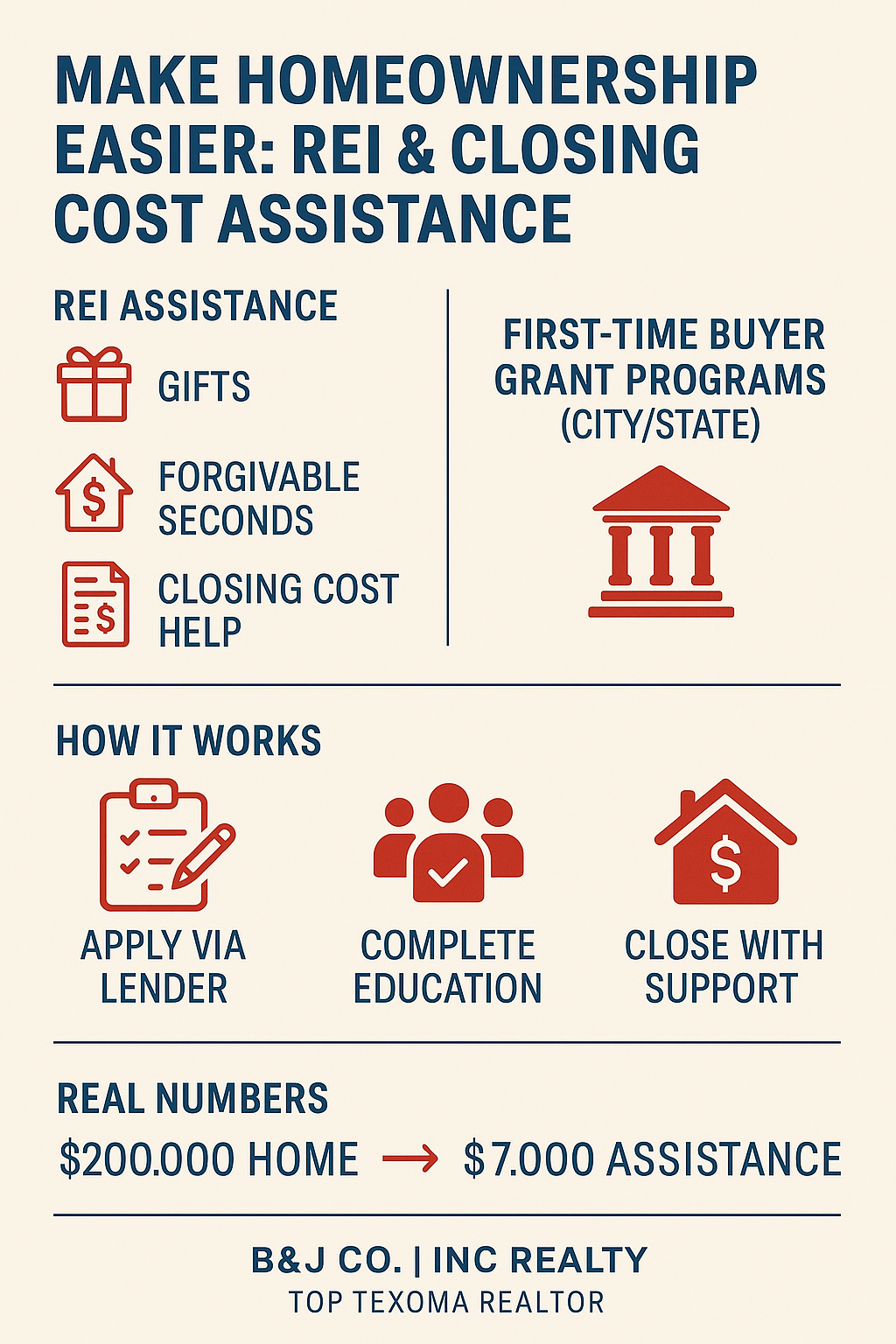

● Assistance may come in different forms: gifts (non-repayable funds), forgivable second mortgages, or amortizing second mortgages depending on the loan and the buyer’s situation. REI Oklahoma+2F&M Bank+2

● It works with common home loan types—FHA, VA, HUD 184, USDA, and conventional—so you don’t need a special or exotic loan to take advantage. FHA.com+3REI Oklahoma+3F&M Bank+3

Because REI partners with lenders, a buyer doesn’t apply directly through REI. Instead, your lender coordinates the assistance on your behalf as part of your financing package.

First-Time Home Buyer Grants & Closing Cost Assistance

Beyond REI, there are several programs in Oklahoma that offer 1st time home buyers grant or closing cost assistance:

● Oklahoma City’s Homebuyer Assistance Program (HOME) can provide up to $18,000 toward down payment and closing costs, plus an extra $5,000 to buy down interest rates in certain cases. SoFi

● The Stillwater Homebuyers Assistance Program offers up to $5,000 in assistance for eligible buyers, forgivable after seven years if you maintain the home as your primary residence. SoFi+1

● Many OHFA (Oklahoma Housing Finance Agency) loan programs include built-in closing cost and down payment assistance—up to 3.5% of the loan—especially for first-time buyers. REI Oklahoma+3Bankrate+3F&M Bank+3

These grants or subsidies reduce the money you must bring to the closing table—sometimes dramatically.

Who Qualifies & How It Works

To benefit from REI Assistance or first-time home buyer grants, you'll need to meet eligibility criteria. These criteria vary by program, but common requirements include:

● A minimum credit score, often around 640 or better. Bankrate+2F&M Bank+2

● A debt-to-income ratio below certain thresholds (often ~45%, with some flexibility). Bankrate+1

● Income limits, varying by county, household size, and program. F&M Bank+2Bankrate+2

● Use of primary residence (you must live in the home).

● Completing homebuyer education courses in many cases.

● Working with an approved lender and using a standard mortgage product that’s acceptable to the assistance programs.

When you apply with a lender, they will build the assistance into your loan package—often structuring it as a second lien (sometimes forgivable) or as a direct subsidy to your closing costs or down payment.

How These Programs Help with Closing Cost Assistance

Closing costs—those additional fees and expenses at the final step of buying a home—include things like:

● Title insurance & fees

● Appraisal, inspection, and survey

● Recording and escrow fees

● Prepaid property taxes, homeowner insurance

● Loan origination, underwriting, credit report fees

Without assistance, buyers often find themselves stretched thin just trying to cover these costs. That’s where closing cost assistance programs shine—they reduce or eliminate out-of-pocket expenses at closing, making help with buying a home much more accessible.

With REI Assistance or first-time buyer grants, many or all of these closing costs may be covered. Sometimes the money is “wired” to the closing authority or title company just before closing, so you don’t have to come up with the cash. REI Oklahoma+2F&M Bank+2

Real Benefits: Numbers & Examples

To illustrate, here’s how the math works in real terms:

| Home Price | 3.5% Assistance (Down + Closing) | What It Covers |

|---|---|---|

| $150,000 | $5,250 | Could cover most closing costs + a portion of the down payment |

| $200,000 | $7,000 | Significant relief on required cash at closing |

| $250,000 | $8,750 | Often enough to eliminate nearly all out-of-pocket closing costs |

Because homes for sale near me in many parts of Texoma and Southeastern Oklahoma fall under ~$300,000, these numbers can make a real difference.

One of the advantages of REI’s Home100 program is that its assistance can be a gift or forgivable second mortgage, depending on your loan structure. REI Oklahoma+2F&M Bank+2 This flexibility gives buyers options.

Steps to Get Started

Here’s how to move forward if you want to seek REI Assistance or first-time buyer grants:

Get pre-approved with a lender who participates in REI / grant programs

Ask about assistance programs at that lender (REI, OHFA, city grants)

Complete required homebuyer education if needed

Search homes—filter for those under program price caps

Submit documentation (income, credit, etc.) to lender

Finalize loan + assistance structure, and close

Working with a realtor near me such as Brian & Jonelle of B&J Co. | INC Realty helps tremendously. They know which homes qualify, which lenders participate, and help manage paperwork and deadlines.

Why Work with a Top Texoma Realtor?

Using these programs effectively often depends on local knowledge and personal guidance. Brian & Jonelle bring:

● Deep familiarity with Texoma and Southeastern Oklahoma real estate

● Experience matching homes with assistance programs

● Connections to REI-friendly and grant-friendly lenders

● Careful negotiation to ensure assistance is applied properly

● Support navigating unexpected hurdles—inspection issues, appraisal shortfalls, etc.

They help you see real home options, not just abstract possibilities.

Caveats & Things to Watch

● Some assistance programs use second liens that must be repaid if you sell or refinance early

● Using assistance can sometimes lead to slightly higher interest rates on the primary loan

● Make sure your home inspection and appraisal align—the assistance is often contingent on the property passing standard criteria

● Not all homes are eligible (some older or non-conforming homes may be excluded)

● You may need to contribute a small amount of your own funds, depending on the program

—

Final Thoughts

If you’ve been searching for homes for sale near me but felt blocked by the costs of down payment or closing, REI Assistance, 1st time home buyers grants, and closing cost assistance open promising paths forward. These programs make help with buying a home real, not just theoretical.

As you explore your options in Texoma and Southeastern Oklahoma, having a trusted guide makes all the difference. Reach out to Brian & Jonelle of B&J Co. | INC Realty, your top Texoma realtor team, and let us help you navigate these programs, find homes that qualify, and take confident steps toward homeownership.